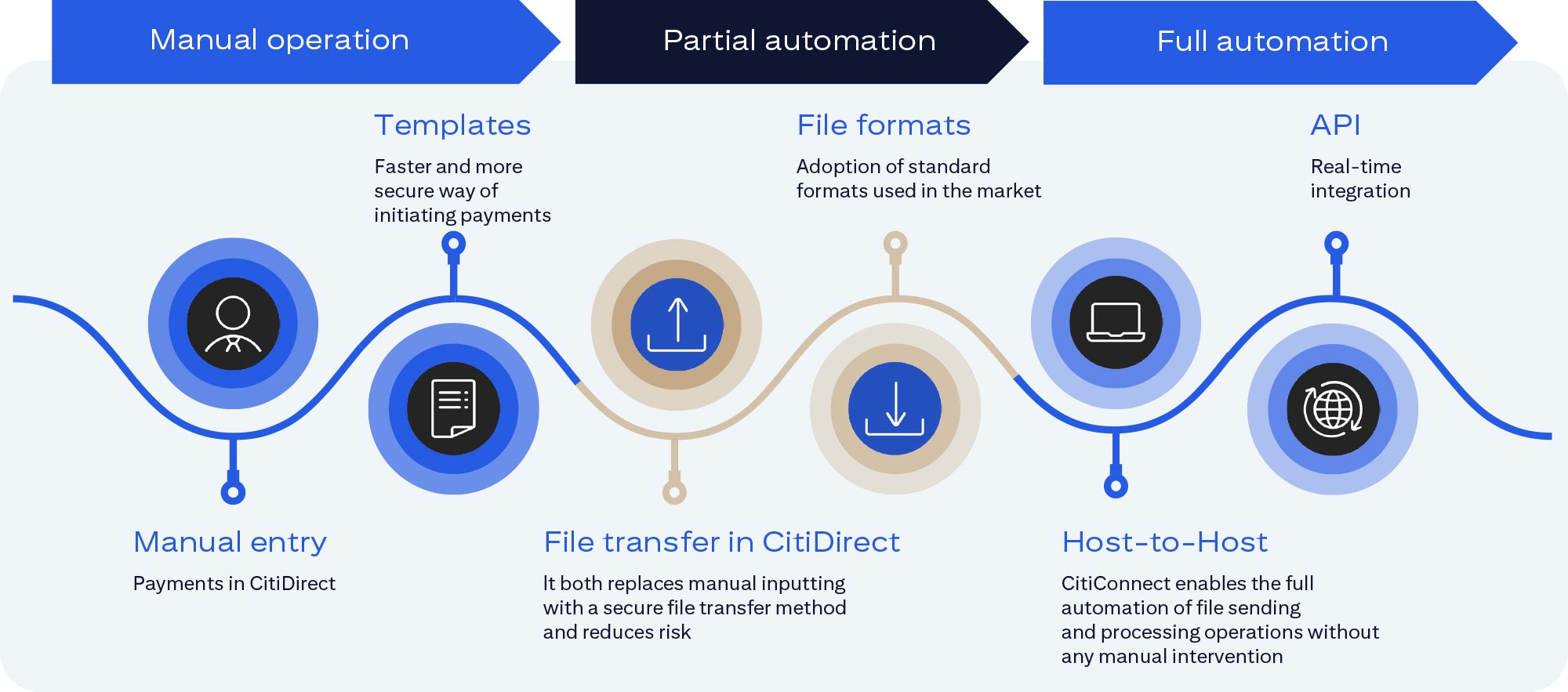

Automation

The need to execute large volumes of transactions and the fast pace of settlements are a challenge for many companies. It is worth using tools that help limit manual work and reduce the risk of error. Modern banking offers many possibilities: from the automation of the most popular functions in the electronic banking system to the direct integration of the financial and accounting system with the bank account. Explore available options and choose your way to increase the comfort and efficiency of your work.

CitiConnect API

It supports full integration with the bank and access to the bank account in real time, without the need to log in to the electronic banking system. CitiConnect API provides users with high work comfort and meets the highest security standards. Payments are made instantly, and access to account information is ensured in real time.

- work in the system without logging in to the CitiDirect system

- time savings and the comfort of work in one environment

- instant execution of payments and real-time account information

- elimination of the manual process – improved work efficiency

- instant response leading to higher end-customer satisfaction

- convenience and safety

- implementation simplified as much as possible

- check bank account balances

- download the operation history for a given day

- download bank statements

- update transfer statuses

- initiate transfers directly from the ERP system

CitiConnect for Files

It increases efficiency and reduces manual intervention in the payment execution process by sending a file with transactions, previously prepared in the client's system, to a dedicated server (Host-to-Host).

- work in one financial and accounting system environment

- no need to log in to the banking system

- shorter time to execute an operation

- improved efficiency, convenience and greater safety

- single access channel allowing for the exchange of data in the form of files in various formats

- Host-to-Host file exchange for a wide range of connectivity options, including SWIFTNet FIN and FileAct

- a wide range of products that can be improved: transfers, collection of receivables, trade finance, and reporting

- a wide selection of formats ensures flexibility with TMS and ERP systems

- optimized to process high-volume files in straight-through processing mode

- advanced reporting capabilities for direct payment reconciliation

CitiConnect for SWIFT

It increases efficiency and reduces manual intervention in the payment processing process by sending a message, properly prepared in the client's system, to a dedicated SWIFT address.

- Host-to-Host exchange for sending messages and files using SWIFTNet and FileAct

- foreign transfers, currency exchange for the money market, statements in the SWIFTNet FIN standard, MT

- ability to make payments and reporting worldwide

- easier and faster integration with the customer's ERP system as regards sending and receiving SWIFT messages

- cost savings by using a single BIC (Bank Identifier Code) to contact all Citi branches

CitiDirect AFRD

When processes in the company require regular access to information, AFRD (Automated File and Report Delivery) is recommended as it allows a user to import files with payments and export reports according to a predefined schedule. Reports and files can be delivered to an e-mail address or HTTPS server selected by the user. Files are imported from the HTTPS server indicated by the user.

- reports are delivered according to schedule defined by the client

- the system recognizes holidays to better manage automated processes

- email notifications inform that an attempt to generate a report has failed

CitiDirect Import

It allows you to upload transactions contained in external files to CitiDirect. When importing a transaction, data correctness is checked to detect errors or incomplete information.

- time savings during the payment initiation process (partial elimination of manual work by importing a ready file with transactions)

- elimination of errors that can occur in the manual process (data are not written, but downloaded from the ERP/Financial & Accounting system)

- improved security when initiating payments (the file with transactions can be encrypted)

- higher efficiency (work directly in the ERP system, without the need to duplicate operations in CitiDirect)

- process control (recognition of payments based on reference numbers assigned in the ERP/Financial & Accounting system)

- encryption of imported files to ensure the confidentiality of the information they contain, e.g. payroll transfer data

CitiDirect Export

A tool that allows you to generate a statement from the CitiDirect system in the form of an electronic data set in a selected format. Such a report can then be imported into the financial and accounting system.

- reports and information on operations performed on bank accounts

- information on payment card transactions

- information on executed direct debit transactions

- information on deposits identified as part of the SpeedCollect and ARMS services

- information on transactions made when servicing other bank products

Digital channels provided by Citi Handlowy

| CitiConnect API | CitiConnect for Files | CitiConnect for SWIFT | CitiDirect | |

|---|---|---|---|---|

| Automation level |

Full Automation | Full Automation | Full Automation | Partial Automation |

|

Distribution according to schedule or on demand |

On demand | Both | Schedule | On demand |

| Real time (instant processing) |

Yes | No | No | Yes |

| Optimal transaction volume sent over a given channel |

Every volume | High | Low | Low |

| Main file/message format |

ISO XML, JSON, XML reporting format |

ISO XML, own, MT (reporting) |

SWIFT MT | Own, ISO XML, MT (reporting) |

| Connectivity options |

API (HTTPS) | SWIFTNet, FileAct, SFTP, FTPS, AS2, HTTPS, EBICS |

SWIFTNet FIN | Internet connection |