Quick and secure currency exchange

Effective currency exposure management tools

No additional fees

-

Automation and integration

- Full automation and integration with TMS/ERP possible

- File upload with transactions’ details

- Cross-currency payments and FX integration

-

Tailored to your needs

- Spot transactions

- Swaps and forwards

- FX order transactions

- Multi-Leg Dealing

-

Technical support

- Helpdesk available Monday to Friday from 8:00 am to 5:30 pm

- Individual introduction to the platform

- Dedicated suport of an experienced FX Dealer

We are constantly changing for you

In 2005, we were the first to provide you with an online currency exchange platform. During this time, we are constantly looking for the best solutions that make it easier for you to navigate the world of finance.

FX trading Automation

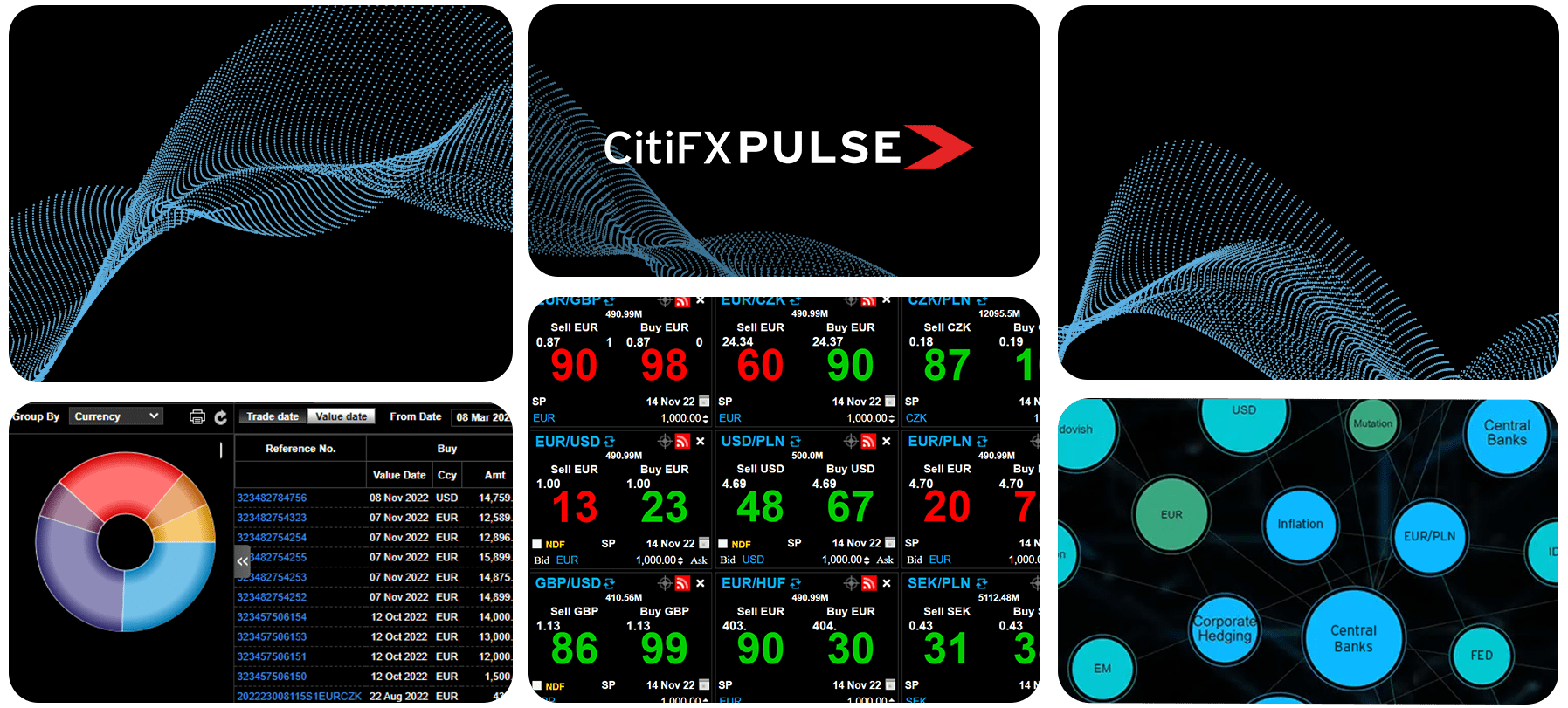

The volatility and complexity of the forex exchange markets are increasingly influencing companies’ financial results. Simplify and accelerate the FX hedging proces with CitiFX Pulse. Self-executing FX transactions!

Award Winning Platform